Sponsor this page. Your banner or text ad can fill the space above.

Click here to Sponsor the page and how to reserve your ad.

-

Timeline

1828 Detail

October 28, 1828 - Opposing the Tariff of Abominations, the state of South Carolina begins the process of a formal nullification campaign, declaring the right of state nullification of federal laws.

The state of South Carolina hated the Tariff of 1828, one in a series of tariffs that Congress had been placing on its commonwealths, states, and territories since the end of the War of 1812. It was a tariff with huge consequences for the Southern economy and beneficial to northern states. Raw materials would be taxed at a 45% rate; a 38% tariff would be levied on imported goods. It was not only the rates which the South thought onerous, it was the impact those rates would have on the British buying cotton from the United States and the heavy hand of the federal government in states against their will. They thought the bill unconstitutional as it favored one part of the nation over another. However, the bill had passed, although not easily, 105 to 94 with 13 not voting in the House of Representatives on April 22, 1828. From Southern states, however, the vote had almost been unanimous against, 4 to 64. The Tariff Bill was agreed to by the Senate 26 to 21 with 1 abstention. It was signed into law by President John Quincy Adams on May 19, 1828.

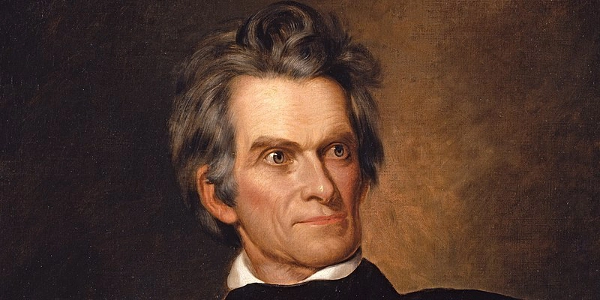

Vice President John C. Calhoun of South Carolina, under Adams, led the charge against the tariff. Its name began to change, with folks in South Carolina and other southern states now referring to it as the Tariff of Abominations. Their ire over its passage pushed the crises to a point where consideration of steps to protest that could include a Nullification Act against federal laws was debated. However, they would take no formal action in the state legislature. Andrew Jackson had won the presidency over Adams, in an election that occurred from October 1 to December 2, 1828; they considered Jackson a proponent of reducing tariffs; after all, Calhoun had been his Vice Presidential nominee in both the 1824 and 1828 elections. Yes, the nominees for Veep for both Adams and Jackson in 1824. Things were different back then.

An anonymous pamphlet was circulated at the time, "South Carolina Exposition and Protest," later known as written by Calhoun. It proposed the idea that a state could nullify a federal law within its borders and questioned the constitionality of tariffs if not to raise revenue.

When this did not occur, and with John C. Calhoun still Vice President under Jackson until (Yes, that does sound odd), South Carolina would revisit the idea of a Nullification Act. Calhoun resigned his post as Vice President in 1832 to return to the Senate. Four years after the Tariff Act of 1828 had been passed, and even with a small reduction in a coming legislation of the Tariff Act of 1832 to address their concerns, the Nullification Act of South Carolina would pass in 1832.

Anger and Response

Included below are two documents, the entire Tariff Act of 1828, and the pamphlet response of John C. Calhoun, urging a discussion, possible nullification, and protest by the state of South Carolina. While the arguments for nullification, and perhaps future secession, many not hold full muster, while reading any part of the Tariff Act (yes, a boring and pedantic exercise), you may better understand the frustration for southern states. It's easy to see the heavy hand of the federal government and its bureaucracy. And the argument on just what constitutes fair state rights even after a vote of their peers for a tariff system that may hurt them still holds true, even without an attempt at nullification. If not for the imposition of the brutal act of slavery into any part of the discussion, merit could have been viewed as purely a states rights versus federal government issue, although some may rightfully disagree with that assessment.

Tariff Act of 1828

An Act in alteration of the several acts imposing duties on imports.

Be it enacted by the Senate and House of Representatives of the United States of America, in Congress assembled, That, from and after the first day of September, one thousand eight hundred and twenty-eight, in lieu of the duties now imposed by law, on the importation of the articles hereinafter mentioned, there shall be levied, collected, and paid, the following duties; that is to say:

First. On iron in bars or bolts, not manufactured, in whole or in part, by rolling, one cent per pound.

Second. On bar and bolt iron, made wholly, or in part, by rolling, thirty-seven dollars per ton: Provided, That all iron in slabs, blooms, loops, or other form, less finished than iron in bars or bolts, except pigs or cast iron, shall be rated as rolled iron in bars or bolts, and pay a duty accordingly.

Third. On iron, in pigs, sixty-two and one half cents per one hundred and twelve pounds.

Fourth. On iron or steel wire, no exceeding number fourteen, six cents per pound, and over number fourteen, ten cents per pound.

Fifth. On round iron, or brazier's rods, of three sixteenth to eight sixteenths of an inch diameter, inclusive; and on iron in nail or spike rods, slit or rolled; and on iron in sheets, and hoop iron and on iron slit or rolled for band iron, scroll iron, or casement rods, three and one half cents per pound.

Sixth. On axes, adzes, drawing knives, cutting knives, sickels, or reaping hooks, scythes, spades, shovels, squares, of iron or steel, bridle bits of all descriptions, steelyards and scale beams, socket chisels, vices, and screws of iron or wood, called wood screws, ten per cent. ad valorem, in addition to the present rates of duty.

Seventh. On steel, one dollar and fifty cents per one hundred and twelve pounds.

Eighth. On lead, in pigs, bars, or sheets, three cents per pound, on leaden shot, four cents per pound; on red or white lead, dry or ground in oil, five cents per pound, on litharge, orange mineral,lead manufactured into pipes, and sugar of lead, five cents per pound.

Sec. 2. And it be further enacted, That, from and after the thirtieth of June, one thousand eight hundred and twenty-eight, there shall be levied, collected and paid, on the importatation of the articles thereinafter mentioned, the following duties, in lieu of those now imposed by law.

First. On wood unmanufactured, four cents per pound; and also, in addition thereto, forty per cent. ad valorem, until the thirtieth day of June, one thousand eight hundred and twenty-nine; from which time an additional ad valorem duty shall amount to fifty per cent. And all wool imported on the skin, shall be estimated as to weight and value, and shall pay the same rate of duty as other imported wool.

Second. On manufactures of wool, or of which wool shall be a component part, (except carpetings, blankets, worsted stuff good, bombazines, hosiery, mits, gloves, caps, and bindings,) the actual value of which, at the place whence imported, shall not exceed fifty cents per square yard,shall be deemed to have cost fifty cents the square yard and be charged thereon with a duty of forty per centum ad valorem, until the thirtieth day of June, eighteen hundred and twenty-nine, and from that time a duty of forty-five per centum ad valorem: Provided, That on all manufactures of wool, except flannels and baizes, the actual value of which, at the place whence imported, shall not exceed thirty-three and one third cents per square yard, shall pay fourteen cents per square yard.

Third. On all manufactures of wool, or of which wool shall be a component part, except as aforesaid, the actual value of which, at the place whence imported, shall exceed fifty cents the square yard, and shall not exceed one dollar the square yard, shall be deemed to have cost one dollar the square yard, and be charged therone with a duty of forty per centum ad valorem, until the thirtieth day of June, eighteen hundred and twenty-nine, and from that time a duty of forty-five per centum ad valorem.

Fourth. On all manufactures of wool, or which wool shall be a component part, except as aforesaid, the actual value of which, at the place whence imported, shall exceed one dollar the square yard, and shall not exceed two dollars and fifty cents the square yard, shall be deemed to have cost two dollars and fifty cents the square yard, and be charged with a duty thereon of forty per centum ad valorem, until the thirtieth day of June, eighteen hundred and twenty-nine, and from that time a duty of forty-five per centum ad valorem.

Fifth. All manufactures of wool, or of which wool shall be a component part, except as aforesaid, the actual value of which, at the place of whence imported, shall exceed two dollars and fifty cents the square yard, and shall not exceed four dollars the square yard, shall be deemed to have cost, at the place whence imported, four dollars the square yard, and a duty of forty per cent. ad valorem, shall be levied, collected, and paid, on such valuation, until the thirtieth day of June, one thousand eight hundred and twenty-nine, and from that time a duty of forty-five per centum ad valorum.

Sixth. On all manufactures of wool, or of which wool shall shall be a component part, except as aforesaid, the actual value of which, at the place whence imported, shall exceed four dollar the square yard, there shall be levied, collected, and paid, a duty of forty-fivce per cent. ad valorem, until the thirtieth day of June, one thousand eight hundred and twenty-nine, and from that time a duty of fifty per centum ad valorem.

Seventh. On woollen blankets, hosiery, mits, gloves, and bindings, thirty-five per cent. ad valorem. On clothing ready made, fifty per centum ad valorem.

Eighth. On Brussels, Turkey, and Wilton carpets and carpetings, seventy cents per square yard. On all venetian and ingrin [ingrain] carpets or carpeting, forty cents per square yard. On all other kinds of carpets and carpeting, of wool, flax, hemp, or cotton, or parts of either, thirty-two cents per square yard. On all patent printed or painted floor cloths, fifty cents per square yard. On oil cloth othern than that usually denominated patent floor cloth, twenty-five cents per square yard. On furniture oil cloth, fifteen cents per square yard. On floor matting made of flags or other materials, fifteen cents per square yard.

Sec. 3. And be it further enacted, That from and after the thirtieth day of June, one thousand eight hundred and twenty-eight, there shall be levied, collected, and paid on the importation of the following articles, in lieu of the duty now imposed by law.:

First. On unmanufactured hemp, forty-five dollars per ton, until the thirtieth day of June, one thousand eight hundred and twenty-nine, from which time, five dollars per ton in addition, per annum, until the duty shall amount to sixty dollars per ton. On cotton bagging, four and one half cents per square yard, until the thirtieth day of June, one thousand eight hundred and twenty-nine, and afterwards a duty of five cents per square yard.

Second. On unmanufactured flax, thirty-five dollars per ton, until the thirtieth day of June, one thousand and twenty-nine, from which time an additional duty of five dollars per ton, per annum, until the duty shall amount to sixty dollars per ton.

Third. On sail duck, nine cents per square yard; and, in addition thereto, one half cent yearly, until the same shall amount to twelve and a half cents per square yard.

Fourth. On molasses, ten cents per gallon.

Fifth. On all imported distilled spirits, fifteen cents per gallon, in addition to the duty now imposed by law.

Sixth. On all manufactures of silk, or of which silk shall be a component material, coming from beyond the Cape of Good Hope, a duty of thirty per centum ad valorem; the additional duty of five per centum to take effect from and after the thirtieth day of June, one thousand eight hundred and twenty-nine; and on all other manufactures of silk, or of which silk shall be a component material, twenty per centum ad valorem.

On indigo, an additional duty of five cents per pound, from the thirtieth day of June, one thousand eight hundred and twenty-nine, until the thirtieth day of June, one thousand eight hundred and thirty, and from that time an additional duty of ten cents per year, until the whole duty shall amount to fifty cents per pound.

Sec. 4. And be it further enactd, That, from and after the thirtieth day of June, one thousand eight hundred and twenty-eight, no drawback of duty shall be allowed on the exportation of any spirit, distilled in the United States from molasses; no drawbck shall be allowed on any quantity of sail duck, less than fifty bolts, exported in one ship or vessel, at any one time.

Sec. 5. And be it further enacted, That, from and after the thirtieth day of June, one thousand and twenty-eight, there shall be levied, collected, and paid, in lieu of the duties now imposed by law, on window glass, of the sizes above ten inches by fifteen inches, five dollars for one hundred square feet: Provided, That all window glass imported in plates or sheets, uncut, shall be chargeable with the same rate of duty. On vials and bottles not exceeding the capacity of six ounces each, one dollar and seventy-five cents per groce.

Sec. 6. And be it further enacted, That, from and after the thirtieth day of June, one thousand and twenty-eight, there shall be levied, collected, and paid, in lieu of the duties now imposed by law, on all imported roofing slates, not exceeding twelve inches in lenght, by six inches in width, four dollars per ton; on all such slates exceeding twelve, and not exceeding fourteen inches in length, five dollars per ton; on all slates exceeding fourteen, and not exceeding sixteen inches, six dollars per ton; on all slates exceeding sixteen inches, and not exceeding eighteen inches in length, seven dollars per ton; on all slates exceeding eighteen, and not exceeding twenty inches in length, eight dollars per ton; on slates exceeding twenty inches and not exceeding twenty-four inches in length, nine dollars per ton; and on slates exceeding twenty-four inches in length, ten dollars per ton. And that, in lieu of the present duties, there be levied, collected, and paid, a duty of thirty-three and a third per centum, ad valorem, on all imported ciphering slates.

Sec. 7. And be it further enacted, That all cotton cloths whatsoever, or cloths of which cotton shall be a component material, excepting nankeens, imported direct from China, the original cost of which, at the place whence imported, with the addition of twenty per cent. if imported from the Cape of Good Hope, or from any place beyond it, and of ten per cent. if imported from any other place, shall be less than thirty-five cents the square yard, shall, with such addition, be taken and deemed to have cost thirty-five cents the square yard, and charged with duty accordingly.

Sec. 5. And be it further enacted, That, in all cases where the duty which now is, and hereafter may be, imposed, on any goods, wares, or merchandises, imported into the United States, shall, by law, be regulated by, or be directed to be estimated or levied upon the value of the square yard, or of any other quantity or parcel thereof; and in all cases where there is or shall be imposed any ad valorem rate of duty on any goods, wares, or merchandises, imported into the United States, it shall be the duty of the collector within whose district the same shall be imported or entered, to cause the actual value thereof, at the time purchased, and place from which the same shall have been imported into the United States, to be appraised, estimated, and ascertained, and the number of such yards, parcels, or quantities, and such actual value of every of them, as the case may require: And it shall, in every such case, be the duty of the appraisers of the United States, and every of them, and of every other person who shall act as such appraiser, by all the reasonable ways and means in his or their power, to ascertain, estimate, and appraise the true and actual value, any invoice or affidavit thereto, to the contrary not-withstanding, of the said goods, wares, and merchandise, at the time purchased, and place from whence the same shall have been imported into the United States, and the number of such yards, parcels, or quantities, and such actual value of every of them, as the case may require; and all such goods, ares, and merchandises, being manufactures of wool, or whereof wool shall be a component part, which shall be imported into the United Sttes in an unfinished condition, shall, in every such appraisal, be taken, deemed, and estimated by the said appraisers, and every of them, and every person who shall act as such appraiser, to have been, at the time purchased, and place from whence the same were imported into the United States, of as great actual alue as if the same had been entirely finished. And to the alue of the said goods, wares, and merchandise, so ascertained, there shall, in all cases wher the same are or shall be charged with an ad valorem duty, be added all charges, except insurance, and also twenty per centum on the said actual value and charges, if imported from the Cape of Good Hope, or any place beyond the same, or from beyond Cap Horn; or ten per centum if from any other place or country; and the said ad valorem rates of duty shall be estimated on such aggregate amount, any thing in any act to the contrary notwithstanding: Provided, That, in all cases where any goods, wares, or merchandise, subject to ad valorem duty or whereon the duty is or shall be by law regulated by, or be directed to be estimated or levied upon the value of the square yard, or any other quantity or parcel thereof, shall have been imported into the United States from a country other than that in which the same were manufactured or produced, the appraisers shall value the same at the current value thereof, at the time of purchase before such last exportation to the United States, in the country where the same may have been originally manufactured or produced.

Sec. 9. And be it further enacted, That, in all cases where the actual value to be appraised, estimated, and ascertained, as herinbefore stated, of any goods, wares, or merchandise, imported into the United States, and subject to any ad valorem duty, or whereon the duty is regulated by, or directed to be imposed or levied on, the value of the square yard, or other parcel or quantity thereof, shall, by ten per centum, exceed the invoice value thereof, in addition to the duty imposed by law o the same, if they had been invoiced at their real value, as aforesaid, there shall be levied and collected, on the same goods, wares, and merchandise, fifty per centum of the duty so imposed on the same goods, wares, and merchandise, when fairly invoiced: Provided, always, That nothing in this section contained to be construed to imposed the said last-mentioned duty of fifty per centum, for a variance between the bona fide invoice of goods produced in the manner specified in the proviso to the eighth section of this act, and the current value of the said merchandise in the country where the same may have been originally manufactured or produced: And, further, That the penalty of fifty per centrum, imposed by the thirteenth section of the act, entitled, "And act supplementary to, and to amend, the act, entited 'And act to regulat the collection of duties on imports and tonnage, passed the second day of March, one thouand seven hundred and ninety-nine, and for other purposes'" approved March first, one thousand eight hundred and twenty-three, shall not be deemed to apply or attach to any goods, wares, or merchandise, which shall be subject to the additional duty of fifty per centum, as aforesaid, imposed by this section of this act.

Sec. 5. And be it further enacted, That, it shall be the duty of the Secretary of the Treasury, under the direction of the President of the United States, from time to time, to establish such rules and regulations, not inconsistent with the laws of the United States, as the President of the United States shall think proper, to secure a just, faithful, and impartial appraisal of all goods, wares, and merchandise, as aforesaid, imported into the United States, and just and proper entries of such actual value thereof, and of the square yards, parcels, and other quantities thereof, as the case may require, and of such actual value of every of them: And it shall be the duty of the Secretary of the Treasury to report all such rules and regulations, with the reasons therefor, to the then next session of Congress.

Approved, May 19, 1828.

South Carolina Exposition and Protest, 1828, John C. Calhoun

Exposition

The committe have bestowed on the subjects referred to them the deliberate attention which their importance demands; and the result, on full investigation, is a unanimous opinion that the act of Congress of the last session, with the whole system of legislation imposing duties on imports - not for revenue, but the protection of one branch of industry at the expense of others - is unconstitutional, unequal, and oppressive, and calculated to corrupt the public virtue and destroy the liberty of the country; which propositions they proposed to consider in the order stated, and then to conclude their report with the consideration of the important question of the remedy.

The committee do not propose to enter into an elaborate or refined argument on the question of the constitionality of the Tariff system. The General Government is one of specific powers, and it can rightfully exercise only the powers expressly granted, and those that may be necessary and proper to carry them into effect, all others being reserved expressly to the States or the people. It results, necessarily, that those who claim to exercise power under the Constitution, are bound to show that it is expressly granted, or that it is necessary and proper as a means to some of the granted powers. The advocates of the Tariff have offered no such proof. It is true that the third section of the first article of the Constitution authorizes Congress to lay and collect an impost duty - a power in its nature essentially different from that of imposing protective or prohibitory duties ... The facts are few and simple. The Constitution grants to Congress the power of imposing a duty on imports for revenue, which power is abused by being converted into an instrument of rearing up the industry of one section of the country on the ruins of another. The violation, then, consists in using a power granted for one object to advance another, and that by the sacrifice of the original object. It is, in a word, a violation by perversion - the most dangerous of all, because the most insidious, and difficult to resist.

Protest

The Senate and House of Representatives of South Carolina, now met and sitting in General Assembly, through the Hon. William Smith and the Hon. Robert Y. Hayne, their Representatives in the Senate of the United States, do, in the name and on behalf of

the good people of the said Commonwealth, solemnly protest against the system of protecting duties, lately adoplted by the Federal Government, for the following reasons:

1st. Because the good people of this commonwealth believe, that the powers of Congress were delegated to it, in trust for the accomplishent of certain specified objects which limit and

control them, and that every exercise of them, for any other purposes, is a violation of the Constitution as unwarrantable as the undisguised assumption of substantive, independent powers not granted, or expressly withheld.

3d. Because they believe that the Tariff Law passed by Congress as the last session, and all other acts of which the principal object is the protection of manufactures, or any other branch of domestic industry, if they considered as the exercise of a supposed power in Congress to tax the people at its own good

will and pleasure, and to apply the money raised to objects not specified in the Constitution, is a violation of these fundamental principles, a breach of a well-defined trust, and a perversion of the humble powers vested in the Federal Government

for federal purposes only.

8th. Finally, because South Carolina, from her climate, situation, and peculiar institutions, is, and must ever continue

to be, wholly dependent upon agriculture and commerce, not only for her prosperity, but for her very existence as a State -

because the valuable products of her soil - the blessings by which Divine Providence seems to have designed to compensate for the great disadvantages under which she suffer in other

respects, - are among the very few that can be cultivated with any profit by slave labor - and if, by the loss of her foreign commerce, these products should be confined to an inadequate market, the fate of this fertile State would be poverty and utter desolation; her citizens, in despair, would emigrate to more fortunate regions, and the whole frame and constitution of her civil polity, be impaired and deranged, if not dissolved entirely.

Deeply impressed with these considerations, the representatives of the good people of this commonwealth, anxiously desiring to live in peace with the fellow-citizens and to do all that in them lies to preservce and perpetuate the union of the State and the liberties of which it is the surest pledge - but feeling it

to be their bounden duty to expose and resist all encroachments upon the true spirit of the Constitution, lest an apparent acquiescence in the system of protecting duties should be drawn

into precedent - do, in the name of the commonwealth of South Carolina, claim enter upon the journals of the Senate, their protest against it as unconstitutional, oppressive, and unjust.

Image above: John C. Calhoun, circa 1845, George Peter Alexander Healy. Courtesy Wikipedia Commons/National Portrait Gallery. Image below: Scene in two parts of the secession movements in South Carolina, 1832 with President Jackson standing strong for the Union and 1864 General McClellan shown as weak toward the south. Lithograph 1864 by Louis Prang and Company. Courtesy Library of Congress. Source Info: History.house.gov; govtrack.us; Library of Congress, Statutes at Large; "South Carolina Exposition and Protest," 1828, John C. Calhoun, Courtesy Warren Hills Regional School District; Wikipedia Commons.