Sponsor this page. Your banner or text ad can fill the space above.

Click here to Sponsor the page and how to reserve your ad.

-

Timeline

1819 - Detail

January 2, 1819 - The first financial crises in the United States, the Panic of 1819, occurs, leading to foreclosures, bank failures, and unemployment. Several causes have been identified, including the heavy amount of borrowing by the government to finance the War of 1812, as well as the tightening of credit by the Second Bank of the U.S. in response to risky lending practices by wildcat banks in the west.

There had been a war ongoing about the role of a central bank in the United States since Andrew Jackson had decommissioned, refused to recharter, the First Bank of the United States in 1811. Could State Banks and local banks handle the financial business of the various states on their own? Would they succeed? Would they fail? And with the War of 1812 coming directly on the heels of the First Bank vanishing, plus the cost of buying the Louisiana Purchase, there was no time to gather information on either of those questions. Fighting had begun along the northeast coast of the Atlantic, as well as in Canada, and around the Great Lakes. The United States needed funds to fight the British, and Canadians, off. After all, they had even burned the White House. They also caused the economy of the United States to suffer as Great Britain blockaded much of the United States exports to reach Europe.

But a funny things happens after wars end. There is a propensity for the winning side to go through a euphoric state of overspending, of banks not doing their do diligence, and in this case, there was no First Bank of the United States to attempt to control the excesses. The state and local banks were playing monopoly, giving out bank notes and credit with very little hard currency backing. This was especially true with land speculation in the west, as well as in a state like Alabama where the rich soil and access to the Gulf of Mexico made transportation easier.

President Monroe, throughout his political career, had expressed that it was the people who bore much of the responsibility, "There is a price tag on human liberty. That price is the willingness to assume the responsibilities of being free men. Payment of this price is a personal matter with each of us."

Monroe, also, had never liked the idea of the First Bank of the United States, but began to change his mind by April 1814. When the war was won, he backed off that thought, before eventual agreement to another central bank.

Buy Chronology

The Second Bank of the United States is Chartered

Some were surprised when President James Monroe floated the idea of opening the Second Bank of the United States. The euphoria was still being felt by most after Andrew Jackson had won the Battle of New Orleans in 1815, ending the War of 1812. Yes, the battle happened after the war was over, but it was a boost to the population anyway. But the rise in the amount of banks during the period directly after the war caused Monroe to abandon the Jeffersonian principles and recharter a national bank in 1816. It began operations in Philadelphia on January 7, 1817. He needed some way to control the bank notes that had no specie (hard currency like gold and silver) to back them up. This was especially true for banks in the west, and although eastern banks were more conservative, they were growing their number at an exponential rate. For example, in 1814-1816, Pennsylvania had chartered thirty-seven new banks. And those banks, in Pennsylvania and elsewhere, had allowed their reserve ratios to hard currencies to drop from a safe 30% to 12%.

One of the first tasks of the Second Bank was to contract the economy and call in those debts. But the speculation had been one tool that had kept the economy roaring, despite signs in Europe that their economy was buying less goods, wheat and cotton, from the United States, even after the end of the war, and causing a depression to start. The export of agricultural goods to Europe had been the main funding mechanism to fund the War of 1812 despite the blockade slowing that economy down. However, by 1819, bank reserves had doubled, now 24%, but the Second Bank of the United States kept tightening and tightening credit at the discretion of its second President, Langdon Cheves, until it had reached 60%. The depression became a crater.

Monroe did not blame the Panic of 1819 on the creation of the Second Bank of the United States. Of course, since it was his creation, it would have been unlikely to expect him to. "That aid which has been refused by the banks, has not been obtained from other sources, owing to the loss of individual confidence from the frequent failures which have recently occurred in some of our principal commercial cities."

So who did he blame instead of the poor management at the Second Bank, ... the decline in manufacturing and the unemployment that caused in the labor force. But while that may have been a cause, the causation was heavily due to poor management in the Second Bank. Huge loans had been given to the public in the Northwest Territory. At one point, a congressional committee called for its disolution. The only way the Second Bank survived was that forty rich men owned stock in it, $35 million initial capitalization, and they didn't want to see their investment disappear. Who were some of the rich men; John Jacob Astor, David Parish, Stephen Girard, Jacob Barker, Alexander Dallas, and Rep. John C. Calhoun.

The Panic of 1819

Banks and businesses closed; unemployment soared. This was the first time the new nation had experienced a panic in the financial sector such as this. They did not know what to do, so they slogged it out, with no true recovery for three years. There was very little President Monroe could or would do; the same could be said for the state governments.

Finally, legislature began to push its way through Congress that helped. The Land Act of 1820 and the Relief Act of 1821 were enacted. In the Land Act, farmers could no longer use credit to buy property, but the price and acreage requirements were lowered. The Relief Act allowed farmers to sell their land back to the government with the proceeds used as a credit against their debts.

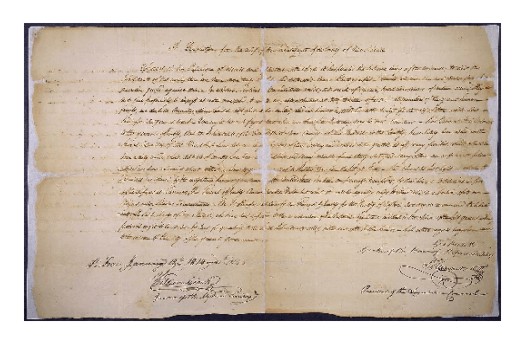

Image above: Photo of the Second Bank of the United States, Philadelphia, 2014, Bestbudbrian. Courtesy Wikipedia Commons C.C. 4.0. Image below: Cartoon depicting the various Financial Panics of the USA from the first in 1819 to 1837, 1857, 1873, 1893, 1894, Louis Dalrymple, Puck. Courtesy Library of Congress. Source Info: "Causes and Effects of the Panic of 1819," 2023, Historyincharts.com; Britannica.com; "Crises Chronicles: the Panic of 1819 - America's First Economic Crises," 2014, James Narron, David R. Skiei, and Donald P. Morgan, libertystreeteconomics.newyorkfed.org; stateoftheunionhistory.com; "The Second Bank of the United States," Andrew T. Hall, federalreservehistory.org; azquotes.com; Wikipedia Commons.