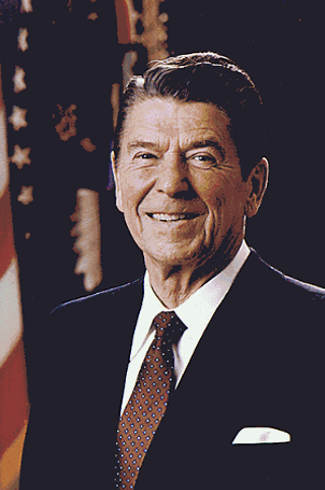

Photo above: President Ronald Reagan. Courtesy Department of Defense, Department of the Navy, Naval Photographic Center. Right: IBM PC circuitboard for the 5150. Courtesy Wikipedia Commons.

Click here to Sponsor the page and how to reserve your ad.

-

Timeline

1989 - Detail

August 9, 1989 - The Savings and Loan Bailout is approved by Congress and signed into law by President George Herbert Walker Bush. The total cost of the bill would approach $400 billion over thirty years to close and merge insolvent Savings and Loans.

The irrational practices of the Savings and Loan industry were in full view after a decade of attempting to bring solvency through at risk investments. While the Savings and Loan industry was first established, 1932, to provide savings and lending to local member residents, the individual associations, after deregulation in the 1980's (Depository Institutions Deregulation and Monetary Control Act of 1980 and the Garn-St. Germain Depository Institutions Act of 1982) and a decade of rampant inflation that caused their core business to suffer, were now approaching their business as if their core did not exist to gain a stable financial footing. By 1982, the entire industry was losing $4 billion per year.

They parlayed the new regulations into risky investments, many in commercial real estate, in far off states where the loan officers had no established expertise, and it was not paying off. The lower regulatory supervision of deregulation allowed some Savings and Loan Associations to cobble together loan portfolios that were too dependent on individual home builders who suffered when mortage rates rose and the housing industry slowed. By the time good economic waters and low unemployment numbers surfaced in early 1989, the Savings and Loan industry was in big trouble. How big? Bailout big. How big a bailout? By the end of the Savings and Loan crises, one thousand and forty-three of the three thousand two hundred and thirty-four Savings and Loan Institutions in the United States were closed or resolved, either by the former Federal Savings and Loan Insurance Corporation (FSLIC) or the soon to be established in the following legislation, Resolution Trust Corporation (RTC).

How did the Problem Start?

The rampant inflation of the early 1980's had caused many of the institutions to incur under water mortgaging caused by an increase in the discount rate they could borrow from the Federal Reserve that was above the mortgage rate for their loans. Why were interest rates so high? Lots of speculation about the cause, but suffice to say, high government spending for the Vietnam War and domestic spending programs instituted during the Presidency of Lyndon Johnson led to monetary inflation which led to a rise in interest rates to curb the inflation. Yes, a circle. Add in the Arab oil crises and the rising cost of fuel and the Savings and Loans were in increasing trouble. Those high interest rates, including a Federal Reserve discount rate at 12% caused an economic recession.

After deregulation, assets in Savings and Loans had grown fifty-six percent, but despite that growth, the assets were in increasingly poor financial shape and not worth the dollar value attached to them. For many, their net worth was in shambles. Even before Congress could act with the new Savings and Loan Bailout Legislation (known as the Financial Institutions Reform, Recovery, and Enforcement Act of 1989), the FSLIC had closed two hundred and ninety-six institutions from 1986 to 1989 with assets of $125 billion. By 1987, the FSLIC Fund to insure the institutions had a net worth of negative $3.8 billion. The problem was particularly large in Texas; in 1988, at the high point of FSLIC failures, forty percent of the failures were in that state.

On March 6, 1989, Texas Congressman Henry Gonzalez introduced legislation to address the crises. By June 15, 1989, it had passed the House of Representatives 320 to 97. On June 21, 1989, the Senate passed their version 91 to 8. After a joint conference committee hammered out the differences, both Houses passed the bill in early August. President George H.W. Bush signed the legislation on August 9, 1989.

What happened afterwards? The Resolution Trust Corporation was established, replacing the FSLIC, and began to handle the closing or sale of failing institutions after January 1, 1989. Between 1989 and 1995, the Resolution Trust Corporation would close seven hundred and forty-seven Savings and Loans to the tune of $394 billion in assets.

What was the cost to the taxpayer? $132 billion. (Initial estimate in the $50 billion range) How much did the Savings and Loan industry pay themselves to solve the problem? $28 billion. Hmmm.

Partial Text, Section 1, Financial Institutions Reform, Recovery, and Enforcement Act of 1989

Title 1 - Purposes

SEC. 101. PURPOSES. 12 USC 1811

The purposes of this Act are as follows:

(1) To promote, through regulatory reform, a safe and stable

system of affordable housing finance.

(2) To improve the supervision of savings associations by

strengthening capital, accounting, and other supervisory

standards.

(3) To curtail investments and other activities of savings

associations that pose unacceptable risks to the Federal deposit

insurance funds.

(4) To promote the independence of the Federal Deposit Insurance

Corporation from the institutions the deposits of which it

insures, by providing an independent board of directors, adequate

funding, and appropriate powers.

(5) To put the Federal deposit insurance funds on a sound

financial footing.

(6) To establish an Office of Thrift Supervision in the Department of the Treasury, under the general oversight of the Secretary of the Treasury.

(7) To establish a new corporation, to be known as the Resolution Trust Corporation, to contain, manage, and resolve failed savings associations.

(8) To provide funds from public and private sources to deal

expeditiously with failed depository institutions.

(9) To strengthen the enforcement powers of Federal regulators

of depository institutions.

(10) To strengthen the civil sanctions and criminal penalties

for defrauding or otherwise damaging depository institutions

and their depositors.

Photo above: Edison Savings and Loan, 1968, Herbert H. Warman. Courtesy Library of Congress. Edison Federal Savings and Loan Association was dissolved and sold to Flushing Savings Bank in 1991. It was established in 1912. Photo below: Treasury Building with statue of Albert Gallatin, 2017. Courtesy Wikipedia Commons. Info source: USGovtrack.us; US Government Printing Office, Statutes at Large; "Savings and Loan Crises Explained," 2019, Kimberly Amadeo, the Balance; Federalreservehistory.org; usbanklocations.com; Wikipedia Commons.